The role of Ergo Oracles

— and what their exceptional features will bring to Cardano

This article refers mainly to the following video from Charles Hoskinson, on the subject of Oracles: Oracle Special — YouTube and my understanding of the implication for the future of Cardano and Ergo. I also add some information from other Emurgo/Ergo videos to complement some missing information completing the global picture. It should not be considered as official information from Cardano, Emurgo or Ergo, it is only my own personal view and you will still have to do your own research.

The role of Cardano and its Stake Pool Operators

Charles announced that the Cardano Stake Pool Operators (SPOs) will run the execution of the data integration APIs — a sort of import function for data coming from Oracles.

The Cardano SPOs will get an infrastructure called the “Oracle Access Layer” that will provide interfaces for smart contracts to operate on. The SPOs will act as a sort of bridge between the external world and what is happening on the blockchain, and they will get paid (and thus incentivised) for running this infrastructure. The SPOs will also have the ability to be a source of data themselves, playing the role of an Oracle.

The Oracle Operator

The Oracle Operators (on Cardano or Ergo) will need:

- a full node wallet

- the Oracle Core: the software that runs the Oracle and posts data on chain

- access to their wallet to pay for transaction fees

- an Oracle Connector which pings external data sources to processes them

Each Oracle Operator will post on chain data that will also contain rich information like for example his collateral.

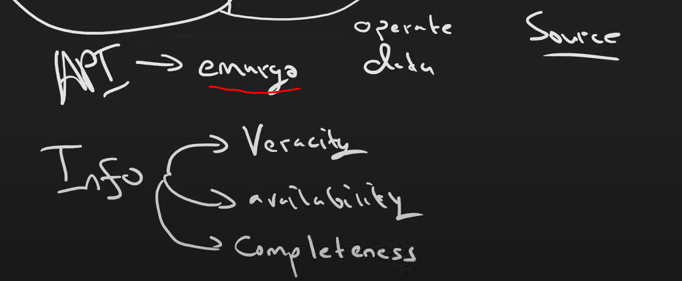

The role of Emurgo

Emurgo is working on these APIs, which is also good for Ergo as there will be natural compatibility between Cardano and Ergo. Emurgo is experimenting a lot of cools things on Ergo with Oracles, stablecoins, privacy and a lot of other DeFi amazing stuff.

The role of Ergo

Ergo is a pioneer in the field of Oracle Pools.

For Cardano this will mean access to more layers of data availability, veracity and completeness all available to programmers on the Cardano blockchain directly from Ergo Oracles through an API.

This feature will probably be required by the most sensitive applications that need a high degree of assurance that the external data can be trusted to execute some important code with high value at risk. And the most sensitive apps and dApps will also probably be the most lucrative ones as they will need the highest degree of assurance they can get.

By working with external sources, Cardano will be able to provide the ultimate experience for developers needing more than just one layer of data veracity verification, and Ergo will be able to further develop Oracle Pools to stay at the avant-garde of these capabilities and provide to Cardano and Ergo smart contract programmers an extraordinarily rich experience.

The Power of Ergo at the service of Cardano

Ergo brings some unique features to the Cardano ecosystem:

- Extended UTXO (like Cardano) but on PoW

- Turing complete smart contracts enabling formal verification with Scala based smart contracts, with a similar protocol design as Plutus on Cardano — which will enable to port very easily contract specifications from Ergo to Cardano

- Sigma protocols (similar to Schnorr signatures) enabling very cheap privacy preserving features embedded directly into the smart contracts, one of the first of its kind.

- Storage rent and garbage collection (remember that an Oracle and Oracle Pool lives in the UTXO on the blockchain because it is the state of the Oracle Pool) — and smart contract and dApps can then reference to these data living on the blockchain. Ergo is one of the first attemtps to solve blockchain bloat entirely with storage rent funded by the process of garbage collection. This approach works in tandem with Cardano’s approach.

- Stateless clients and Headless dApps

- Integration in Yoroi together with Cardano with a great user experience

By building the most complex tools for DeFi and making them simple to use, Ergo is positioning itself as a possible future Goldman Sachs of the decentralised financial world.

What are Ergo’s Oracle Pools

Ergo’s Oracle Pools are a tool enabling a lot of new possibilities in terms of assurance. There are different hierarchies that will be constructed:

- First layer: Oracles, or data aggregation from different Oracles

- Second layer: Individual Oracles together into Oracle Pools with the possibility of collateral slashing for better data reliability (this feature is not implemented on Chainlink)

- Third layer: A Pool of Oracle Pools

The Extended UTXO Model enables for the construction of complex data structures on top of existing ones (by still remunerating the data that is used at each step of the construction) for very customised applications, giving permissioned and permissionless flexibility.

Another way of augmenting the assurance of the data in the future will be to construct a 3D layering by embedding also :

- the cost of corruption,

- incentives,

- special consensus rules like deviation checking,

- different combinations like deviation checking with stake slashing enabling giving for example an economic estimate of the amount needed to corrupt all Oracle Pools, so that dApps can build their assurance on game theory

The role of Wolfram and Singularity.net

The Cardano Oracle Access Layer will be able to make queries to different data sources. The first one to be quickly integrated will be Wolfram because it’s the most complete in terms of quantity and quality of information.

Cardano will thus develop with Wolfram and its other partners (AGI — Singularity.net and of course Emurgo) an “Oracle Query Language” capable of aggregating all data sources smoothly with the Cardano smart contracts. I expect a natural compatibility between Cardano and Ergo.

Wolfram and AGI will cooperate with Cardano to build this query language, which will enable Cardano smart contract developers to have access to a rich experience of data flowing from this “Great Oracle Pipeline”.

Partnering with Chainlink

Cardano believes in choice, so anyone can create its own external oracle source and plug it in the system, and Chainlink will also be available.

Why a multiplicity of Oracles is good?

At a later stage, Cardano will offer the possibility of layering verification sources for the best fine-tuning of the level of assurance available to smart contracts.

Oracles are only as good as the quantity and quality of data they provide. And smart contracts are only as good as the quality of data they work with.

The best data you can have, the better are your applications and their capabilities. That is why Cardano made the choice to provide as many sources as possible to smart contract developers.

If the smart contract is on Cardano, the Access Layer will be run by SPOs. The Oracles and Oracle Pools on Ergo will be considered as an external data provider.

In this landscape the Ergo Pools would compete with Chainlink in a free market, as it’s the programmer of the smart contract on Cardano that will have the choice to use whatever he wants as a source and structure it as he wants.

But at the end, developers will come to Cardano because they will have access to a competitive environment of data sources, and this competition will guarantee the best prices for data.

The advantage of Cardano and Ergo Oracles

Thanks to the UTXO model, a dApp can create multiple transactions into on transaction (which is not possible with the account model of Ethereum), each dApp requiring data from Oracles can at the same time submit ADAs or ERGs into the dApp and also at the same time take a small percentage of this amount and send it to the Oracle, and so in only one transaction, the dApp is able to use the funds for the its own purpose and at the same time funding the Oracle, which makes it more simple for very big dApps to fund Oracles Pools in the ecosystem and create some sort of public good of data funded by these big dApps.

This simplicity will be a competitive advantage for Oracles running the Cardano or Ergo core software.

Now is the right time to build your own Oracle infrastructure, as Cardano and Ergo will open a whole new market, and provide new and better alternatives to current existing data providers. The business opportunities are significant.

The Island, The Ocean and the Pond — and beyond!

If Emurgo is working on the data integration APIs, we can probably assume that these “Oracle Access Layers” and “Language Queries” should also be interoperable with Ergo smart contracts.

In this case, programmers will also have the choice between

- having their smart contract on Cardano or Ergo and easily switch between them, or

- having one part on Cardano because some part of the execution needs something PoS is best at providing (governance for example), and another part of the smart contract logic on Ergo because Ergo provides some other unique capabilities like privacy, that are derived from the mathematical specifities of PoW.

This way Cardano and Ergo, together, will provide the best of both worlds.

And beyond Cardano and Ergo, every stakeholder of the ecosystem will benefit from this open philosophy.